Every day, we face countless temptations to buy things we don’t truly need. Flashy ads, limited-time sales, and the thrill of instant ownership trigger impulsive spending. But by adopting a simple strategy—a 24-hour pause before making a non-essential purchase—you can reclaim control over your finances and your life.

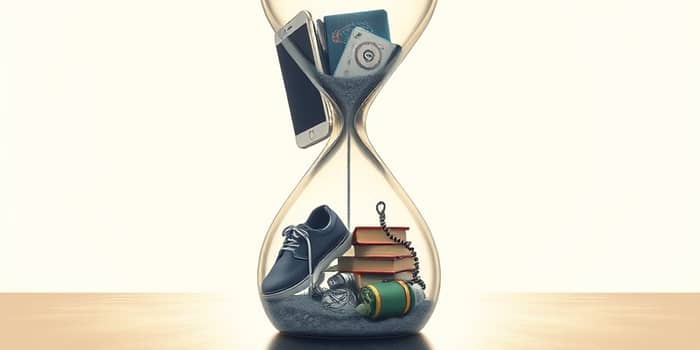

The 24-hour pause is a technique where you delay purchasing a non-essential item for a full day. Instead of clicking "buy now," you add the item to a wish list, cart, or note. You then step away, allowing time and perspective to guide your choice.

By the time 24 hours pass, the initial rush of excitement and the influence of marketing ploys will have diminished. At that moment, you can assess whether the purchase holds genuine value or simply feeds an impulsive urge.

Human brains love instant gratification. When we encounter a tempting offer—a steep discount or a sleek new gadget—dopamine floods our system, urging us to buy immediately. This chemical reward reinforces quick decisions, even when they clash with our long-term interests.

The 24-hour pause leverages cognitive psychology by letting that dopamine surge subside. With impulse out of the driver’s seat, your rational mind gains room to evaluate the purchase. This shift from emotional to logical thinking empowers you to make rational choices rather than chase fleeting thrills.

Sleep and reflection further boost mental clarity. Giving your brain time to rest and revisit the opportunity in a fresh state helps you identify whether the purchase aligns with your real goals.

Impulse buys often lead to regret and wasted funds. By waiting a day, you curb unnecessary spending and cultivate a sense of financial control. Small purchases that slip through every week can amount to hundreds of dollars each year.

Consistently applying the pause builds a habit of careful evaluation. Over months, those savings compound into significant long-term financial gains.

Buyer’s remorse is more than an annoying feeling—it’s a sign your impulses outpaced your judgment. The 24-hour rule reduce stress and financial anxiety by allowing you to commit only to purchases that matter.

This method also reduces time spent chasing sales and scrolling through endless product pages. With fewer impulsive excursions, you free up energy for hobbies, relationships, and personal growth.

By breaking free from compulsive spending, you reinforce self-respect and develop foster lasting self-discipline and awareness. In turn, mindful consumption becomes second nature, enriching your lifestyle.

Consider someone who paused before buying discounted sneakers. After a night’s sleep, they realized they already owned half a dozen pairs and skipped the purchase—saving $65. That money later funded a weekend getaway.

Another individual used the pause to compare warranties on a new laptop. A day of research revealed a refurbished model with better coverage, saving 15% and providing peace of mind.

Experts across personal finance blogs and podcasts confirm that adopting this simple rule reduces impulse buys by up to 50%. Families on tight budgets often report freeing up hundreds of dollars monthly, which they redirect to meaningful expenses.

While 24 hours is a powerful baseline, you can tailor the rule. For larger purchases—like electronics or furniture—a 48- or 72-hour pause might be more appropriate. This extended window offers extra time to compare prices, read reviews, and explore ethical considerations.

Integration with online tools further streamlines the process. Many e-commerce platforms allow cart saving and wish-list notifications. Use these features to set automatic reminders, ensuring you revisit items thoughtfully.

Remember, the rule’s purpose is not to eliminate all spontaneous joy but to differentiate between fleeting wants and genuine needs. Feel free to adapt the timeframe when an item aligns with a pre-established budget or plan.

Impulse spending seduces us with the promise of instant gratification, but it often leaves us empty-handed—and empty-pocketed. By adopting a simple 24-hour pause, you learn to pause emotion, invite reflection, and make choices that align with your goals.

This habit redirect funds toward genuine priorities and empowers you to make rational choices, fostering lasting satisfaction and peace of mind. Over time, you’ll notice not just financial improvements but a deeper sense of freedom and purpose in your consumption habits.

Start today: the next time you feel the pull to buy on impulse, pause for a day. Let your future self thank you.

References