Constructing a multi‐bucket portfolio tailored to different time horizons is a foundational strategy for both new and seasoned investors. By segmenting assets based on when funds are needed, you can better manage volatility and preserve capital.

Whether you are planning for a major purchase in a few years or mapping out retirement decades away, buckets create clarity. This approach aligns your longer the time horizon the greater potential benefit with appropriate asset classes and risk levels.

An investment time horizon is the period one expects to hold an investment before needing the proceeds. It acts as a guiding metric for selecting asset classes, balancing risk, and aiming for returns that meet your specific financial objectives.

Defining a horizon is crucial because the period one expects to hold an investment directly affects the portfolio’s volatility tolerance. Short windows demand stability, while longer frames allow for more aggressive positioning and the power of compounding.

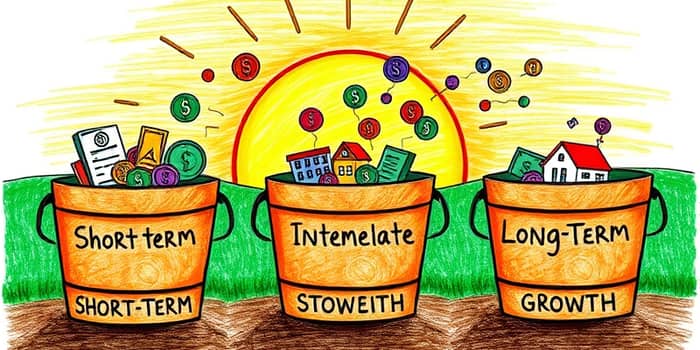

Financial planners typically recognize three primary time buckets. Each has its own blend of assets and risk profile aligned with when you’ll use the funds:

Creating buckets involves matching each segment of your portfolio with assets suited to its timeframe. Below is a streamlined view of how to allocate and maintain these buckets:

Bucket planning offers several compelling advantages that enhance your financial resilience and emotional confidence:

Consider a retiree with a $1 million portfolio. By dividing assets into three buckets, they address upcoming needs while preserving growth potential:

- Short-Term Bucket: $100,000 in cash and short bonds to cover living expenses for the next three years.

- Intermediate Bucket: $300,000 in intermediate-term bonds, balanced mutual funds and REITs to fund years four through ten.

- Long-Term Bucket: $600,000 in diversified equities, real estate, and private equity for retirement income beyond year ten and to outpace inflation.

In a strong market, returns from the long-term bucket can be periodically directed to replenish the other two, reinforcing stability and growth.

Time horizon and risk tolerance are closely linked. Shorter horizons demand a conservative stance because market declines may not recover before you need the money. Conversely, long horizons allow for more risk and the potential of higher long-term returns.

For example, someone saving for a down payment in two years should favor capital preservation, while a thirty-year retirement timeline can accommodate an aggressive, equity-focused mix, benefiting from market cycles.

When building your buckets, remember to account for these factors:

Inflation Risk: Long-term assets like stocks and real estate typically outpace inflation and preserve purchasing power.

Liquidity Needs: Confirm that short-term holdings are easily accessible without penalties.

Income Reinvestment: Decide whether dividends or interest from intermediate and long-term assets will be reinvested or distributed.

Private Equity Lock-Ups: Recognize that private investments often have extended lock-up periods, so classify them strictly as long-term.

Segmenting your portfolio into time-based buckets empowers you to meet both near-term obligations and distant objectives with confidence. By aligning assets to when you’ll need them, you navigate market volatility, optimize growth, and cultivate peace of mind throughout every stage of your financial journey.

References